A summary of the tax implications for EMI option holders under various different scenarios

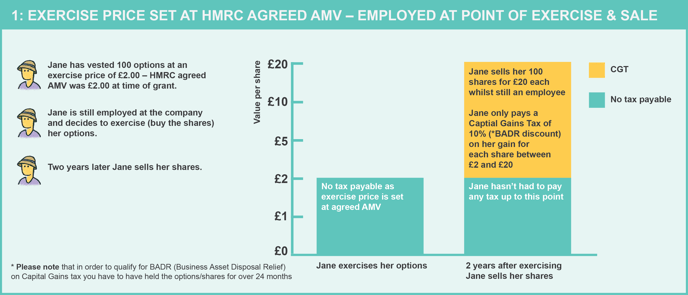

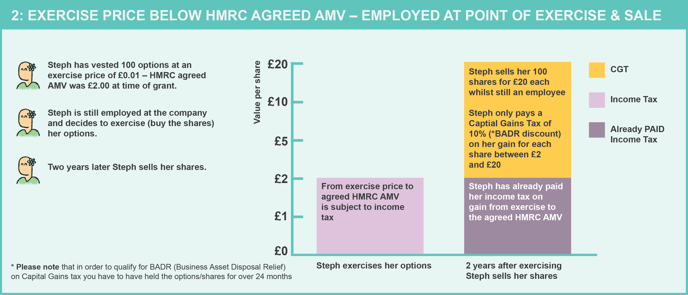

IF YOU ARE STILL AN EMPLOYEE with the company that granted you the options

Exercising your options when still an employee (or within 90 days of leaving the company).

- If the exercise price is at, or above, the AMV (Market Value) agreed with HMRC at the time of grant, there is no income tax to be paid, and no ITEPA S431 election needs to be made.

- If the exercise price is below the AMV (Market Value) agreed with HMRC at the time of grant:

2A. So long as the shares cannot be immediately sold (eg not during an Exit event), then income tax is payable on the difference between the exercise price and the AMV. This should be paid via your annual tax return. In addition you should fill in an ITEPA S431 election within 14 days to ensure that no income tax is liable on any eventual sale of the shares.

2B. If the shares can be immediately sold (ie during an Exit event), then both income tax and NI must be paid on the difference between the exercise price and AMV (agreed with HMRC at the time of grant) – initially by the company, via the company’s PAYE system, and then must be re-imbursed back to them by you within 90 days.

Selling your shares when still an employee (does NOT include 90 days of leaving the company).

When you sell the shares exercised from an EMI option, you will have to pay Capital Gains tax (CGT) on any gain over the exercise price or AMV agreed (whichever is higher).

- So long as you have held the options and/or shares for a total of 24 months, this will currently mean that you gain Business Asset Disposal Relief (BADR, formerly called Entrepreneur’s Relief) associated with EMI, so the CGT is only taxable at 10%.

- If you have not held the options and/or shares for a total of 24 months and you sell them – you will need to pay the standard rate of CGT.

Capital Gains need to be declared and will be taxed accordingly (to the extent that any gain is over the individual allowance) within your annual tax return.

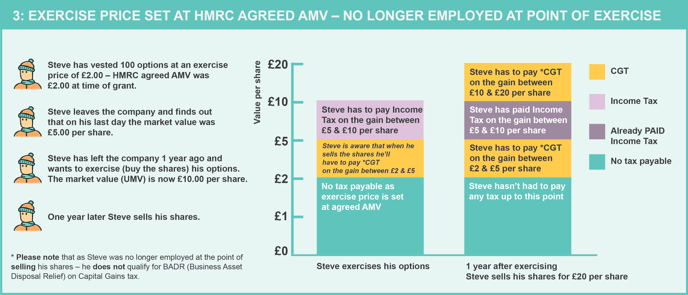

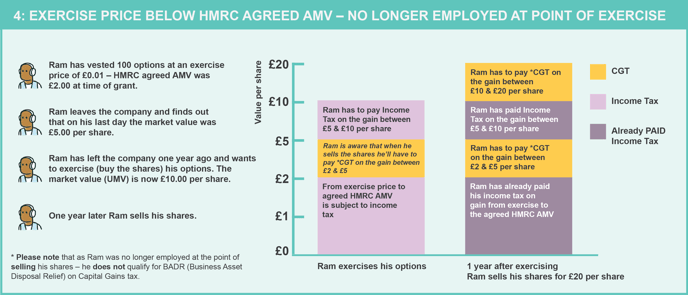

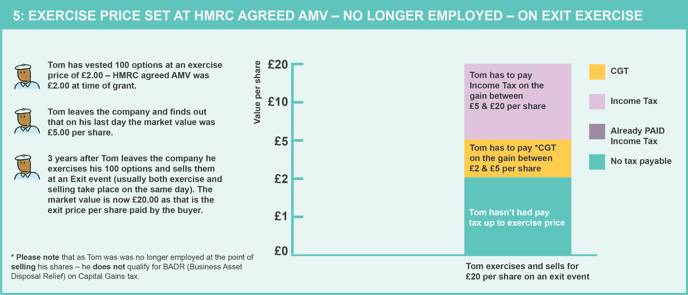

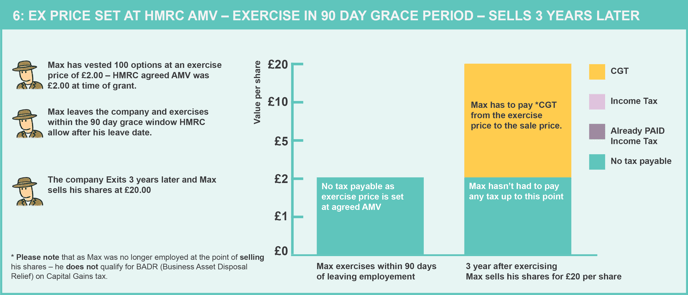

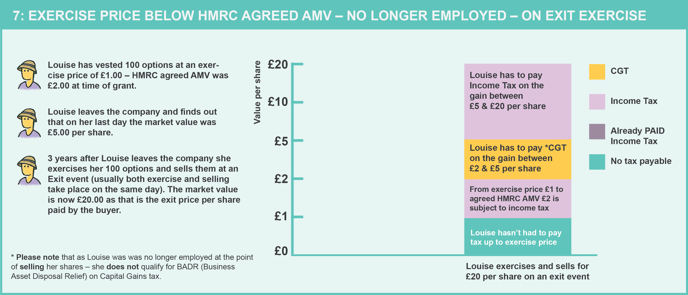

IF YOU ARE NO LONGER AN EMPLOYEE with the company that granted you the options

Leaving a company and then exercising the options (more than 90 days after leaving)

It is important to note that although your EMI income tax treatment gives you a 90-day grace period after your employee leave date, the Business Asset Disposal Relief on Capital Gains Tax lapses as soon as you leave employment – regardless of whether you have held the options/shares for 24 months from the grant date.

If you leave the company that granted you the options, and are allowed to keep them, they become non-eligible for EMI income tax treatment 90 days after leaving.

This means that any gains in value from that point are treated as income (and are taxable as such) up to the point when the options are exercised. Any gain before leaving will be treated as per the employee rules above.

It is therefore important that you know the Actual Market Value (AMV) of the shares over which you have options at the time you leave the company. You will also need to know the AMV of the shares when you exercise them.

In addition, when you exercise them, you need to decide whether they should be taxed at that point at AMV or Unrestricted Market Value (UMV). The UMV is typically higher, so will lead to a higher income tax charge at that point, but then any gain from that point onwards will only be subject to CGT

In the case of choosing UMV as the tax point at exercise, it is very important that an ITEPA S431 election is carried out to ensure that only CGT is liable at the point of sale.

If you decide to pay income tax at this point only on AMV, then on sale you will be partly exposed to income tax on any further gains.

Selling your shares when not an employee

When you sell the shares exercised from an EMI option, you are then due to pay Capital Gains tax (CGT) on any gain over the exercise price or AMV (whichever is higher), up to the value of the shares when you left the business.

You will also be subject to tax on any gains from their value when you exercised them to their sale value. If you paid income tax on exercise at UMV, and declared as such via the ITEPA S431 election, then only CGT will be applicable. If income tax was only paid up to a lower AMV, then a portion of the subsequent gain will also be subject to income tax.

Selling your shares back to the company of issue

HMRC will likely treat a share buyback as a distribution (see our Buy Back guide), which will fall under Dividend Tax (a type of income tax) rather than Capital Gains Tax. Therefore you will lose your Business Asset Disposal Relief benefit on CGT of 10% regardless of whether you have held the options/shares for 24 months from the grant date.

Our team, content and app can help you make informed decisions. However, any guidance and support should not be considered as 'legal or financial advice.'