The process to formally record when an employee leaves the company as well as full and part cancellations of EMI, CSOP and unapproved options.

The most common reason for option cancellations is when an employee leaves the company.

For EMI options, this is a disqualifying event and the employee needs to be processed as a leaver and (if applicable) exercise any options within 90 days of leaving to keep the EMI income tax treatment.

However, Business Asset Disposal Relief is lost if the shares are sold when no longer employed by the company.

Other reasons can include cancellation by mutual consent (e.g. for an error in the agreement and regrant of the option) or cancellation in line with the terms of the option agreement (e.g. bad leavers).

In any scenario, cancelling EMI, CSOP or unapproved options in a compliant manner is a straightforward process.

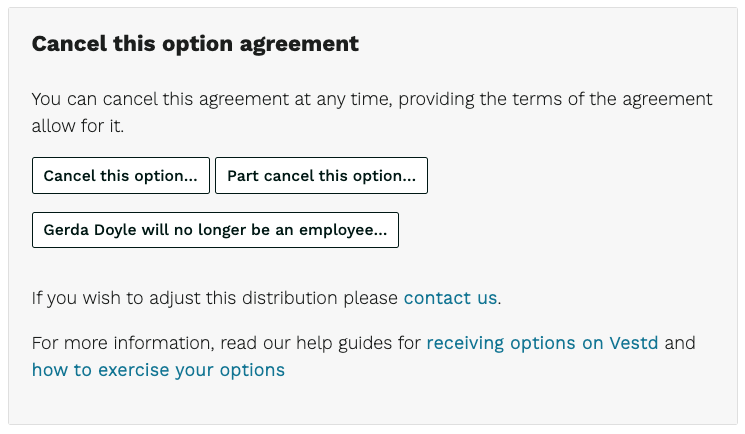

Log in to Vestd and from the side navigation select Share schemes > All option agreements. From there, click on the agreement you want to cancel and scroll down to Cancel this option agreement.

There you’ll have the choice to cancel all of the recipient's options, part-cancel their options, or state that they're no longer an employee.

Click the appropriate button to begin the cancellation.

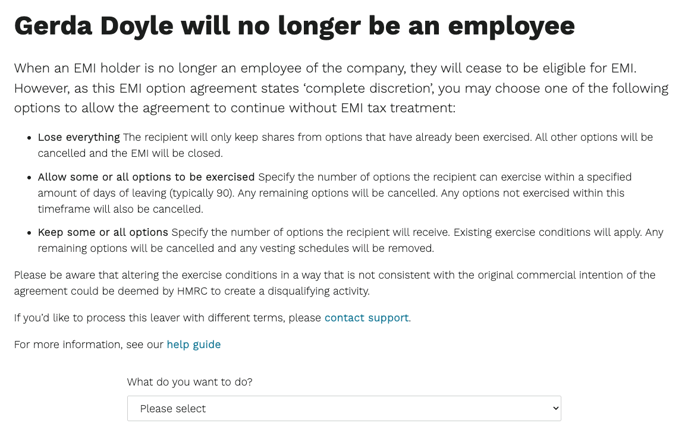

If the option holder is no longer an employee

When someone leaves employment, their leaver clause will already be determined when the scheme was first created. Unless "Complete discretion" was selected, then you can decide what happens to the leaver's options.

Simply enter the date they will leave (or left) the company and fill in the required details based on their leaver clause.

- If the employee is an EMI option holder and their options are exercisable upon leaving, they must be exercised within the time period stated during the process (typically 90 days) to maintain the EMI income tax treatment. However, Business Asset Disposal Relief is lost on the sale of the shares if no longer employed by the company.

- For unapproved options that are exercisable upon leaving, the employee must exercise within the time period stated (typically 90 days), otherwise they will be cancelled.

- For CSOPs that are exercisable upon leaving, the employee must exercise within the time period stated (typically 90 days), otherwise they will be cancelled. Unless the leaver qualifies for one of the 6 exemption clauses, then they have 6 months to exercise.

For EMI options that aren't exercised within 90 days, you should obtain a company valuation at the time of leaving to ensure the correct tax is paid when the options are eventually exercised. You can do this through Vestd by going to your Valuations page, starting a new valuation and selecting Exercise valuation.

Once you're happy with the terms for this leaver, click Confirm to notify them.

Their agreement will be updated with the number of options they can keep and/or exercise, and any remaining options will be cancelled.

Board Minutes will be automatically generated and stored in your Documents folder.

It’s worth knowing that the Vestd Option Agreement has a clause that states when an employee leaves the company, their options will automatically lapse 16 weeks after the leave date if no action is taken. So it's important you process leavers before this, ideally well within the 90-day exercise window.

Cancelling the option in line with the terms of the agreement

If the option is being cancelled in line with other terms of the agreement, please enter additional details as to what terms haven’t been met. For example:

- Failure to meet the conditions set when issuing the options

- The options have lapsed and cease to be exercisable (e.g. the period in which the options can be exercised has passed)

- The option holder has had their employment contract terminated

If you’re unsure whether the reason for cancellation falls in line with the terms of the agreement, please refer to the option agreement in the top right corner of the Agreement summary page:

Once you’ve entered the details, click Confirm to cancel the option. The platform will automatically generate Board Minutes (which will be stored in Documents) and notify the recipient of the reason for cancellation.

Cancelling options by mutual consent

When you select ‘This option is being cancelled by mutual consent' (e.g. due to an error during the allocation process, or because you have agreed to issue replacement options instead), you’ll be prompted to download an Agreement for Surrender.

Complete the form with the information required; a company director and the recipient must sign the Agreement for Surrender as a formal record of consent.

After you’ve downloaded the Agreement for Surrender, click Confim. You’ll then be taken to the Agreement summary.

When both parties have signed the Agreement for Surrender, upload it to Vestd for your records. It will then be saved in Documents along with the Board Minutes.

Part-cancelling options

The part-cancellation process is slightly different, as you will need to enter the number of options you wish to cancel.

You can only cancel un-exercised options, any exercised options cannot be cancelled. Un-vested options will be cancelled first then vested options will be cancelled if required.

If you're part-cancelling the options by mutual consent, the Agreement for Surrender will be on the following Agreement summary page once the part-cancellation has been confirmed.

So don't forget to download the Agreement for Surrender, fill in the required information and ensure both parties sign it, then upload the completed document to Vestd.

Finally, if the option agreement you're part-cancelling uses time-based vesting, the automatic vesting schedule will be removed and you will need to manually vest any remaining options going forward.

Once the part-cancellation is confirmed, scroll down the Agreement summary page and select Enable accelerated vesting.

Then you will just need to return to this Agreement summary page to manually vest the options as and when required.

Our team, content and app can help you make informed decisions. However, any guidance and support should not be considered as 'legal, tax or financial advice.'