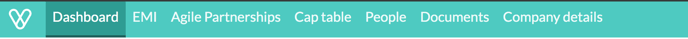

First, log onto the platform and go to your Dashboard in the top left:

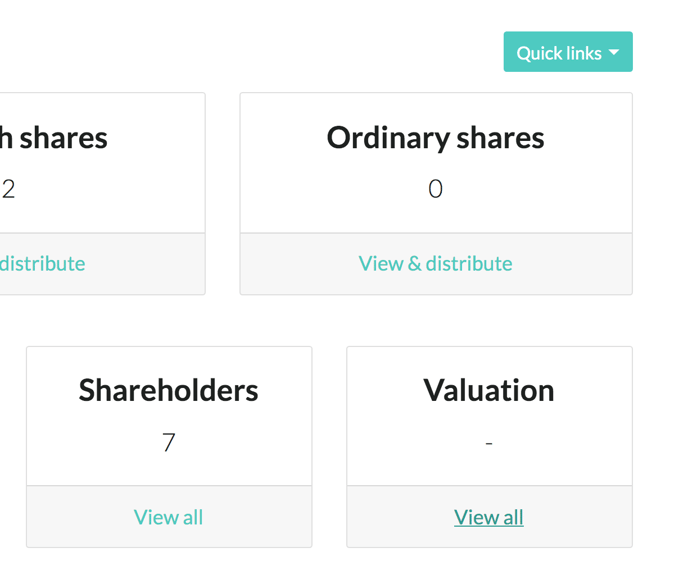

From here, click View all under Valuations:

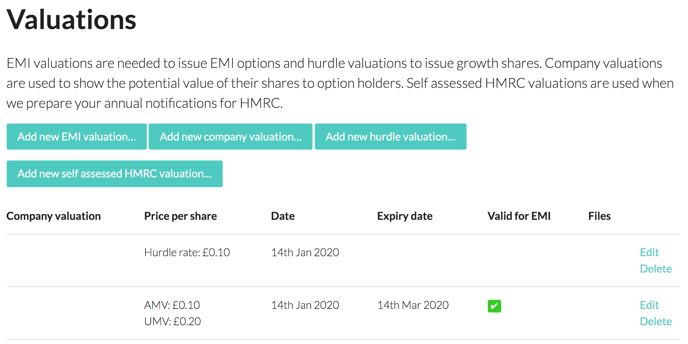

Which will take you to the valuations page, where you will be able to see your existing valuations, and add new ones:

Click on the relevant button, follow the instructions on the following page then just click Save as draft at the bottom, and you're done!

Here is a breakdown of the different kinds of valuations:

There are a few different kinds of valuations you will need to add to the platform, all of which we can carry out for you in house (just get in touch with valuations@vestd.com). All of the valuations are covered in this article.

- EMI valuation

- This needs to be approved by HMRC, and will leave you with two values (AMV and UMV). It is possible to start to distribute EMI Options before receiving the confirmation letter, but in most cases it is better to wait and be sure that your values have been confirmed.

- You will need to select:

- Share class

- Actual Market Value (AMV)

- Unrestricted Market Value (UMV)

- Whether the valuation has already been approved by HMRC

- Start and Expiry dates

- File to upload for reference (HMRC approval letter, VAL231, or Valuation Report)

- Company valuation

- This is a projected company value that will be displayed to your option holders. This could be a value agreed from a recent fundraising round, debt raise round or a formal valuation done by your accountant. This does not need to be pre-accepted by HMRC.

- You will need to select:

- Source

- Whole company valuation

- Valuation date

- Hurdle valuation

- This does not need to be pre-accepted by HMRC, but needs to be done before issuing Growth Shares and kept on record.

- You will need to select:

- Hurdle price per share

- "Valid from" date

- Self assessed HMRC valuation

- This does not need to be pre-accepted by HMRC, but is needed when issuing or exercising unapproved options for UK employees and directors, or exercising EMI options.

- You will need to select:

- Share class

- Actual Market Value (AMV)

- Unrestricted Market Value (UMV)

- Start date