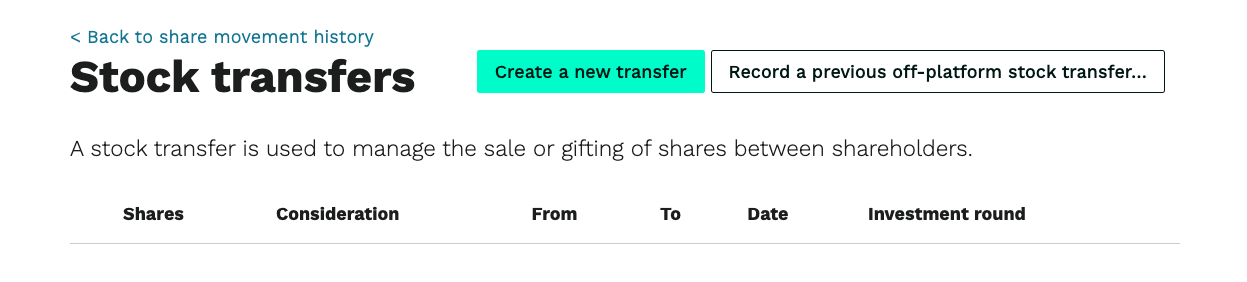

Create new transfers on-platform and record previous off-platform transfers.

If a shareholder is gifting or selling their shares to another person or back to the company, a stock transfer is needed to maintain an up-to-date record with HMRC.

The process for both new and previous stock transfers is the same, except some of the questions will be worded differently depending on the type of transfer (e.g. you’ll be asked to upload existing documents for previous stock transfers and to generate new documents for new transfers).

First, log in to your account and go to Share capital > Stock transfers via your side navigation, then select Create a new transfer or Record a previous off-platform transfer.

Here you’ll enter the details of your stock transfer, including:

- The share class you're transferring the shares from

- Who the shares are being transferred from (please note, if you can’t select the shareholder's name it’s because their residential/company address is missing. You can add their address by going to Secretarial & admin > Shareholders then select the shareholder’s name and click Add address)

- Who the shares are being transferred to (if the recipient isn’t on the dropdown list, click Add a shareholder. You’ll also need to add their address)

- The number of shares to be transferred

- The total price to be paid for all the shares (cash consideration)

- Whether the total price is over £1,000 (if so, the stock transfer won’t be completed until the proof of stamp duty payment PDF is uploaded to the platform)

Stamp duty is calculated at 0.5% of the value of the stock transfer and then rounded up to the nearest £5.

Then, depending on your company governance, you may need to authorise the stock transfer with director and shareholder resolutions. If so, select whether you need to generate a new resolution, upload a signed resolution, or select from your existing company documents.

Depending on whether this is a new or previous stock transfer, you’ll be prompted to generate new or upload an existing share purchase agreement and stock transfer form. For previous transfers that exceed £1,000, you’ll be asked to upload the stamp duty receipt PDF here too.

Once you’ve entered all the details and uploaded any documents, click Generate the stock transfer. Don’t worry nothing gets sent out yet and you’ll have the chance to edit any details if needed.

Here you’ll see an overview of the stock transfer details with a few more steps to complete:

If you’re recording a previous transfer and have uploaded the proof of stamp duty payment PDF, the following steps should already be completed. If so, click Start the stock transfer to record the transfer on Vestd.

For new transfers, the resolutions, share purchase agreement and stock transfer form will be sent to the relevant parties via DocuSign for their digital signatures. Once everything looks correct, click Start the stock transfer to send the necessary documents for signing. You’ll be notified by email when the documents have been signed, and you can view the stock transfer status by going to the Stock transfers page.

When all the documents have been signed and the stamp duty has been paid, you’ll then be prompted to upload the stamp duty receipt PDF (if applicable).

That’s the stock transfer complete and saved on Vestd!

Our team, content and app can help you make informed decisions. However, any guidance and support should not be considered as 'legal, tax or financial advice.'