A broad overview of the steps to setting up an Agile Partnership using Conditional Shares

Whether you are just learning about Agile Partnerships and what they are, or are already beginning to set one up, this article will give you an overview of the process and point you in the right direction.

Agile Partnerships are frameworks that determine equity rewards based on legally binding performance milestones. Everybody knows what they’re expected to bring to the game. Equity is released in a way that is proportionate to what people contribute.

The interpersonal aspects of a partnership are as important as the technical details, and there is much to be gained by minimising the risk of this friction affecting the business, especially in its early stages. The challenge is to do this in a way that is fair for all parties, that each partner gets a say in, and that does not carry the price tag of a specialised legal team.

This is the challenge the Agile Partnership rises to meet. Rules are agreed upon at the start, by all parties, and the equity structure of the business then dynamically reflects what each partner is contributing compared to their agreed-upon targets.

Before you continue reading this article, since an Agile Partnership makes use of Conditional Growth Shares, it would be helpful to familiarise yourself with the following two concepts:

The very first step of setting up an Agile Partnership is ensuring that your Articles of Association allow Conditional Shares. If they do not, you can adopt the Vestd standard Articles of Association by following these steps on the platform.

While a similar process will also work for more mature businesses, one of the most common use cases for an Agile Partnership is when the business is in its early stages, so the company may still be of zero value. That means the growth share Hurdle is at nominal value or zero, and as the business grows, these shares will have the same value as would an Ordinary class of share. If you are a more mature business looking to set up a similar Partnership, get in touch with a member of our team at support@vestd.com.

Now it's time to plan how you want the Partnership to look.

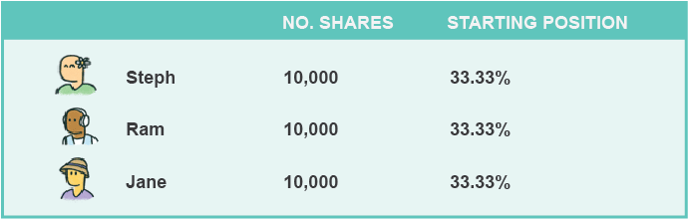

First, start with the current shareholding position:

When you begin to set up your Agile Partnership, the Vestd platform will know how many shares are currently in your company.

If it has fewer than 10,000 shares, we'd recommend performing a subdivision to make the equity more easily distributable amongst Agile Partnership recipients. It also lowers the nominal value of the conditional shares - meaning recipients won't have to pay as much upfront.

Whether your company has 1, 100 or 1,000 shares, we recommend subdividing by a factor of 10 - usually to 1 million shares - to keep things simple and avoid having a recurring nominal value share price.

Subdivisions cause dilution, but they don't change the value of a company; they simply increase the number of shares in the company which makes it easier to distribute equity. In other words, subdivisions slice the pie into smaller pieces, but the size and value of the pie remain the same.

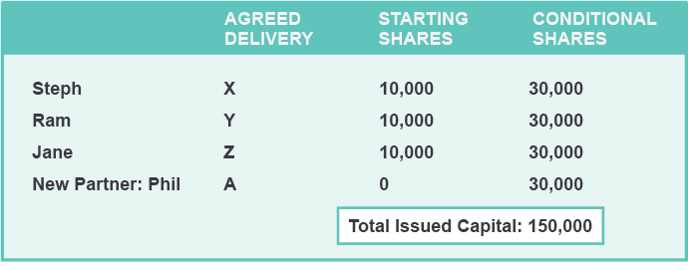

Second, establish the future shareholding assuming 100% delivery by each participant of what they are committing to bring to the business:

This will give you the number of new conditional growth shares to be issued to each individual.

(Here is how you start setting up Conditional Growth Shares on Vestd)

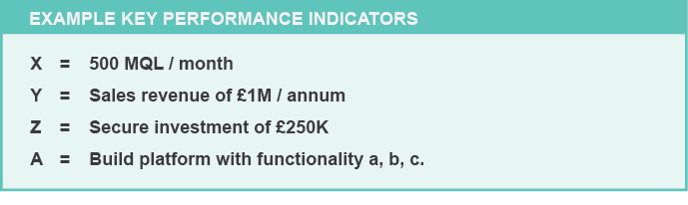

Third, establish what each person must deliver:

There are some basic rules to keep in mind when deciding upon these Key Performance Indicators (KPIs). They should be:

- Tangible

- Measurable

- Specific

These could be as simple as time contributed over the initial years, or more specific and tangible like:

Getting this level of clarity between the participants at this stage may seem challenging, but it forces important conversations before they turn into big problems later down the line. These conversations, and getting clear on what each member of the team is going to bring to the table, are tough, but so important to get clear as early as possible.

Define vesting timing and criteria:

In the case of Conditional Shares, vesting actually means the removal of conditionality. The shares that do not get made unconditional (do not vest) can be Deferred (effectively cancelled).

This vesting can happen over time, or as certain sub-milestones are met within the broader specified delivery. The thing to decide at this point in the process is exactly how many shares can vest each time a sub-milestone is met, or a given amount of time passes.

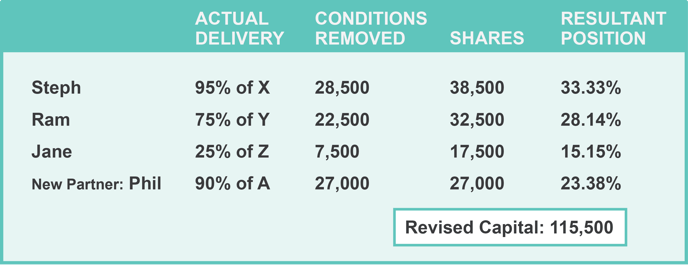

Finally, let time pass:

Over time, the actual delivery of each recipient will dynamically change their equity position within the company to reflect their contribution in relation to the performance markers set at the start of the process.

Not everyone will necessarily be happy, but this is fairer than maintaining the original structure that would not have reflected milestones met and goals delivered.

The process can start again

As mentioned at the start of the article, Agile Partnerships as described here are intended for early-stage businesses of zero or near-zero value. A similar process can be implemented for more mature businesses, but since their Hurdle rate is likely to no longer be zero, their equity structure more complex, their milestones more varied, and a valuation record established, a detailed conversation will need to be had with a member of our team. Get in touch with us at support@vestd.com to book a call.

Our team, content and app can help you make informed decisions. However, any guidance and support should not be considered as 'legal, tax or financial advice.'