What are share class restrictions in relation to a share scheme, why they matter and what you need to do?

In a nutshell, share class restrictions are the limitations, restrictions and conditions placed on the shares in that share class.

These restrictions can define how shares could be transferred, and often carry specific limits or restrictions. Some common restrictions we see – and that are often best practice when setting up a share scheme – are clauses such as:

- Drag and Tag clauses which force the shareholder to sell if the majority wish to sell

- Pre-emption rights that give existing shareholders the right to buy the shares first, pro rata. Pre-emption rights essentially restrict the ability of the current shareholder to sell to whomever they like.

- Employee shareholder buy-back rights that mean if an employee leaves they may have to sell their shares back to the company

- Restricted rights to dividends or voting

These restrictions are found in a company's Articles of Association or Shareholders' Agreement. We've given further details on this at the end of this guide

It's worth adding that share class restrictions don't refer to the commercial vesting terms that you give to the options (e.g. time- or performance-based), but rather the restrictions on the shares themselves once exercised.

What do I need to do when creating a share scheme?

The good news is that only CSOP share schemes require the share class restrictions to be added to the agreement itself. When you're granting CSOP options, we will prompt you to add the restrictions when needed.

For other share schemes, such as EMI or Unapproved options, they don't need to be added to the agreement, but the restrictions must be made available to the recipient. On Vestd, your company's Articles of Association are always available for option recipients to view, so they can see these restrictions at any point.

How to make share class restrictions visible to your CSOP recipients

As explained above, we will prompt you when you need to add any restrictions or confirm there are no restrictions. We will remind you when you're adding your CSOP recipients.

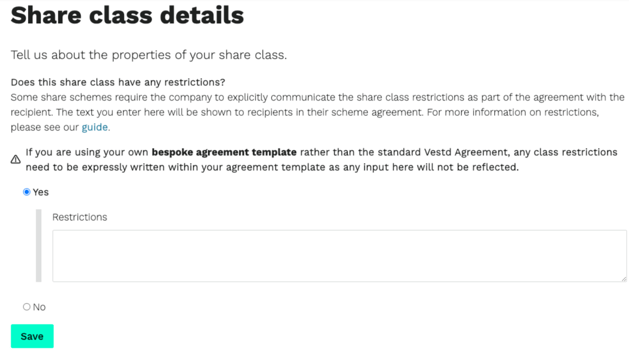

If you wish to add the restrictions ahead of time, navigate to your Share classes (on the left-hand side go to Share capital > Share classes), click on the share class you're issuing CSOPs over, and click Edit, as shown below

Where to find your share class restrictions

These restrictions are found in your company's Articles of Association or any Shareholders' Agreement:

- If you have adopted the Vestd Articles of Association, the restrictions are detailed at the bottom of this guide. Don't forget to check any Shareholders' Agreement in place that may contain additional restrictions.

- If your company is on Model Articles of Association, you don't need to add any restrictions, unless you have a Shareholders' Agreement.

- For custom Articles of Association, you must add all share class restrictions. It's best practice to reference a summary of the restrictions and the clause in which they can be found in the Articles or the Shareholders' Agreement. For example: "Drag along rights as outlined in Article 5.3 of the Company Articles."

- If you do have a Shareholders' Agreement, please add the relevant clauses in their entirety. Chances are the Shareholders' Agreement is a confidential document, so including the relevant clauses in full protects your shareholders while also ensuring your share scheme remains compliant.

What are the Vestd Articles of Association class restrictions?

The class restrictions laid out in the Articles of Association with these shares are as follows:

Transfers of Shares (Articles 13, 16)

Leaver Transfers (Article 14)

Permitted Transfers (Article 15)

Compulsory Transfers (Article 18)

Drag along (Article 20)

Our team, content and app can help you make informed decisions. However, any guidance and support should not be considered as 'legal or financial advice.'